Partnership agreement checklist ontario

Ontario Partnership Agreement with Special Unit Provisions

Prepare a Partnership Agreement for an Ontario partnership with this template, which provides for a special partnership unit to be issued for assets vended in.

- Ordinary partnership units are issued to the partners in accordance with their financial contributions, and a special unit is issued to one partner which has vended in certain assets to be used by the partnership business.

- The holder of the special unit will be allocated profits (or losses) in addition to those allocated among the ordinary units.

- Partnership units of a withdrawing partner will be distributed among the remaining partners pro rata their holdings, except for the special unit, which will be redeemed in exchange for a promissory note.

- This legal contract template is available as a fully editable and customizable MS Word document.

- Intended for use only in the Province of Ontario, Canada.

Add to cart

Ontario Partnership Dissolution Agreement

Wind up an Ontario general partnership with this Partnership Dissolution Agreement.

- The remaining partner buys out the interest of the resigning partner and assumes the partnership debts and obligations, in order to continue carrying on business.

- The partners will post an advertisement in The Ontario Gazette to notify interested parties of the dissolution.

- This legal template is provided in MS Word format and is fully editable to fit your particular circumstances.

- Intended for use only in the Province of Ontario, Canada.

Add to cart

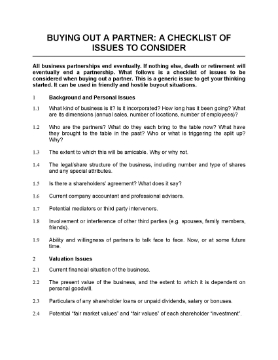

Partnership Buyout Checklist

Before you buy out your partner's interest in your business, read this 6-page checklist of issues you need to consider, such as:

- valuation and financial status of the partnership business;

- alternatives to a buy-out;

- preservation of the value of the partnership;

- setting the purchase price;

- financing;

- tax and legal issues.

Buying out a partner can be difficult and stressful. The Partnership Buyout Checklist is a handy tool to help you work through the process. Download yours today.

Add to cart

Customers who bought this item also bought

Independent Contractor Agreement | Canada

Reduce your employer contributions by hiring workers as contractors instead of employees with this Independent Contractor Agreement for Canadian businesses.

- The independent contractor is responsible for remitting their own payroll deductions and taxes and for filing their own GST returns (if applicable).

- The contractor is not eligible for the company's employee medical benefits, pension fund or other incentive plans.

- The contractor agrees not to disclose or use any of the company's confidential information disclosed to the contractor during the term of the contract.

- This engagement contract template can be used in most Canadian provinces and territories except for Quebec.

- You can cut costs and increase your monthly cash flow by retaining staff on a contractor basis. Buy and download the Independent Contractor Agreement for Canada today.

Add to cart

Organizational & Minute Book Forms Package | Canada

You've incorporated a federal business corporation in Canada. Now you need to organize it. Download this package of Organizational Forms for a Canadian business corporation.

- a set of corporate By-laws;

- organizational resolutions of the initial directors and shareholders;

- Consent to Act forms to be signed by each director and â„ or officer of the company;

- a register of share transactions to record the initial share issuances;

- shareholder ledgers, to be filled out for each shareholder;

- register of directors and managers of the corporation.

The Canada Organizational and Minute Book Forms Package is downloadable and easy to use, and contains everything you need to organize a new corporation.

Add to cart

Partnership Agreement for Professional Corporations | Canada

Form a partnership between two professional corporations with this template Partnership Agreement for Canadian businesses.

- Application. The Partnership Agreement can be used by legal, accounting, architectural, consulting, medical or other professionals to help share the costs of the practice, as opposed to operating as a sole practitioner which can be much more costly and constitute a much larger business risk.

- Operations and Capital Contributions. The partners mutually agree on how the business and operations of the partnership will be conducted, and the responsibilities and capital contributions of each of the partners.

- Debts and Liabilities. Each partner is responsible for paying his/her own debts, and must keep the partnership property and the interests of other partners free from claims or demands.

- Assignment. Partners cannot assign their partnership interest or incur liabilities which might put their interest in danger of attachment.

Purchase the Canada Partnership Agreement for Professional Corporations by adding it to your cart and checking out. You'll be able to download it and use it at your leisure.

Add to cart

Annual Corporate Resolutions | Canada

Prepare the Annual Resolutions of the shareholders and directors of a Canadian business corporation with this package of forms.

In small privately held corporations, it is common to pass Resolutions instead of holding a formal annual meeting, to deal with all the business that must be covered in the corporation's annual meeting.

- Resolution of the directors appointing the corporate officers and approving the financial statements.

- Resolution of the voting shareholders approving the financials and electing the directors.

- Resolution of all of the shareholders appointing auditors or waiving the audit requirement.

- Cover letter to be sent by a law firm to its corporate clients, enclosing the forms and giving instructions to the client.

This package of Canada Annual Resolutions Forms can be used for federal companies and in Alberta, British Columbia, Saskatchewan, Ontario, New Brunswick, Nunavut, Yukon and Northwest Territories. French language translation required for Quebec.

Add to cart

Directors Resolution to Authorize Employee Bonuses | Canada

Pass a Directors Resolution authorizing the payment of employee bonuses with this easy template for Canadian corporations.

- The Board of Directors authorizes bonuses be paid to certain employees, in specified amounts.

- The Board also sets the remuneration to be paid to the directors.

- This Directors Resolution template can be used by federal companies and by companies incorporated in any province or territory of Canada that has a Business Corporations Act. A French translation is required for use in Quebec.

- This downloadable template form can be reused as often as you like.